Tax Credits for Small Employers Offering Health Coverage

The Patient Protection and Affordable Care Act provides a tax credit for an eligible small employer (ESE) for nonelective contributions to purchase health insurance for its employees. The term "nonelective contribution" means an employer contribution other than an employer contribution pursuant to a salary reduction arrangement.

Qualified small employers, generally those with no more than 25 full-time employees with an average annual full-time equivalent wage of no more than$51,800 (for 2016; adjusted annually for inflation) will be eligible for a tax credit of up to 50% (35% for tax-exempt 501(c) organizations) for up two years, of the cost of non-elective contributions to purchase health insurance purchased through a state or federal marketplace (SHOP) for its employees. (Note, however, that the phase-out of the credit operates in such a way that an employer with exactly 25 full-time equivalent employees or with average annual wages exactly equal to $51,800 for 2016 is not eligible for the credit. The maximum credit is available to employers with no more than 10 full-time equivalent employees with annual full-time equivalent wages from the employer of less than $25,000.)

The credit percentage that can be claimed varies with the number of employees and average wages.

Calculating the credit amount - The credit is equal to the lesser of the following two amounts multiplied by the applicable tax credit percentage and subject to the phase-outs discussed later:

(1) The amount of contributions the eligible small employer made on behalf of the employees during the tax year for the qualifying health coverage.

(2) The amount of contributions that the employer would have made during the tax year if each employee had enrolled in a plan with a premium equal to the average premium for the small group market in the rating area in which the employee enrolls for coverage, also referred to as the small business benchmark premium. Contributions under this method are determined by multiplying the benchmark premium by the number of employees enrolled in coverage and then multiplied by the uniform percentage that applies for calculating the level of coverage selected by the employer.

To figure the reduction of credit when the limits are exceeded, the number of the employer’s full-time equivalent employees and average annual full-time equivalent wages (AAEW) for the year must be determined.

Figuring the number of full-time equivalent employees - An employer's full-time equivalent employees (FTEs) for 2016 is determined by dividing the total hours the employer pays wages during the year (but not more than 2,080 hours per employee) by 2,080. The result, if not a whole number, is then rounded down to the next lowest whole number if any (unless the result is less than one, in which case, the employer rounds up to one FTE).

Calculating average annual wages (AAEW) - Average annual equivalent wages is determined by dividing the employer’s total FICA wages (without regard to the wage base limitation) for the tax year by the number of the employer's full-time equivalent employees for the year (rounded down to the nearest $1,000 if need be).

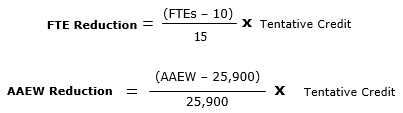

Credit reduction - If the number of full-time equivalent employees exceeds 10 or if AAEW exceed $25,000, the amount of the credit is reduced (but not below zero). Both reductions can apply at the same time!

Example – Joe owns a small wood working business and has 12 employees, not counting himself or family members. The total FICA wages (without regard for wage base limitations) for the year were $297,500 and total hours worked by his employees during the year were 24,400. None of his employees worked more than 2,080 hours during the year. Joe made non-elective contributions to purchase health insurance for his employees in the amount of $49,800 for the year. He has not claimed the small business health insurance credit in any other year. Joe’s credit is determined as follows (the $25,900 amount used in the AAEW reduction formula is for 2016; this amount is adjusted annually for inflation):

- Small Business Benchmark Premium (estimated for this example. In actual practice the benchmark premiums are included in the instructions for Form 8941) = 12 x 5,345 = $64,140

- Smaller of actual premium paid or Benchmark premium = $49,800

- Tentative credit = $49,800 x 0.50 = $24,900

- Full-time equivalent employees (FTEs) = 24,400/2080= 11.7 rounded down = 11

- Average annual full-time equivalent wages (AAEW) = $297,500/11 = $27,045 rounded down = $27,000

- FTE Reduction = ((11-10)/15) x $24,900 = $1,660

- AAEW Reduction = ((27,000-25,900)/25,900) x $24,900 = $1,058

- Joe’s health insurance tax credit = $24,900 - $1,660 - $1,058= $22,182

Other Issues:

- The credit reduces the employer's deduction for employee health insurance.

- Special rules apply if the employer benefits from state tax credits or a premium subsidy paid by the state for providing health insurance for its employees.

- Aggregation rules apply in determining the employer.

- Self-employed individuals, including partners and sole proprietors, 2% shareholders of an S Corporation, and 5% owners of the employer are not treated as employees for purposes of this credit.

- There's a special rule to prevent sole proprietorships from receiving the credit for the owner and their family members.

- The credit is a general business credit that can offset the taxpayer’s income tax, and if the amount of the credit is greater than the tax, the excess can be carried back one year and forward for 20 years. However, because an unused credit amount cannot be carried back to a year before the effective date of the credit, any unused credit amounts for taxable years beginning in 2010 can only be carried forward.

- The credit is available to offset tax liability under the alternative minimum tax.

|

|  |