IRS Regulations Clarify Business Pass-Through Deduction

Article Highlights:

Article Highlights: - Trade or Business Definition

- Qualified Business Income

- Limitation Thresholds

- Specified Service Trade or Business

- Reputation or Skill

- Wage Limitation

- Proper Wage Allocation

- Qualified Property

- Depreciable Period

- Bonus Depreciation and Sec 179

- Negative QBI and Carryovers

- Multiple Activities

- REITS and Publicly Traded Partnerships

- Anti-Cracking Provisions

The Treasury Department and the IRS finally released the 184 page proposed regulations on August 8, 2018, explaining how they interpret and propose to apply the provisions and limitations included in the legislation. The regulations are “proposed” and the IRS is asking for feedback from stakeholders. So these are not the “final” regulations and have left some unanswered questions.

One of the more important issues related of the legislation is the definition of a “trade or business” since that describes the kind of activity that can create income for purposes of the new 199A deduction. The tax code does not provide a definitive “bright line” definition of a trade or business and the new regulations simply adopted an existing subjective definition, that relies on the outcomes of past court cases and interpretive rules the IRS has issued under code section 162 which is the most familiar provision using the term “trade or business”. This leaves some room for interpretation; most notably whether or not rental real estate income qualifies for the Sec. 199A deduction. Our tentative research finds that except for totally passive rental real estate activities such as triple net leases, a rental real estate activity is a trade or business for purpose of section 199A.

The Sec 199A deduction does apply to virtually all pass-through income, referred to as qualified business income (QBI), from all trades or businesses if the taxpayer receiving the income has a taxable income less than the threshold for the 32% tax bracket. For married couples filing a joint return the threshold is $315,000 and for all other filing statuses, the threshold is $157,500. So, if you are receiving QBI in the form of the net profit from a sole proprietorship, K-1 income from a partnership or S corporation, and hopefully the net profit from a rental, your Sec 199A deduction will be 20% of that QBI, figured separately for each business activity.

The deduction is taken below the line, which means it does not change your adjusted gross income (AGI), which limits other tax benefits, and it does not reduce your self-employment tax. It is deducted in a manner similar to your itemized or standard deductions on your 1040 tax return.

However, once your taxable income goes above those thresholds the computation of the deduction becomes more complicated and for those in a specified service trade or business (SSTB) it is the beginning of the end for the deduction. In the case of a SSTB, the deduction begins to phase out if your taxable income is between $315,000 and $415,000 for married couples filing jointly and between $157,500 and $207,500 for other filing statuses. Thus once your taxable exceeds the $415,000 and $207,500 levels there is no 199A deduction from a SSTB.

Reputation or Skill - Although the original legislation provided a list of the type of businesses that were SSTBs there still remained a lot of uncertainty about some business types, especially regarding one very subjective definition of a SSTB which specified that where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees or owners the business activity was an SSTB. Did this mean, for example, that a self-employed plumber who provided his skill for the business wouldn’t be eligible for the 199A deduction? In a taxpayer-friendly interpretation, the regulations clarify that the plumber and others like him would qualify by defining “reputation and skill” to mean:

(1) Receiving income for endorsing products or services, including an individual’s distributive share of income or distributions from a relevant pass-through entity (RPE) for which the individual provides endorsement services;

(2) Licensing or receiving income for the use of an individual’s image, likeness, name, signature, voice, trademark, or any other symbols associated with the individual’s identity, including an individual’s distributive share of income or distributions from an RPE to which an individual contributes the rights to use the individual’s image; or

(3) Receiving appearance fees or income (including fees or income to reality performers performing as themselves on television, social media, or other forums, radio, television, and other media hosts, and video game players).

(2) Licensing or receiving income for the use of an individual’s image, likeness, name, signature, voice, trademark, or any other symbols associated with the individual’s identity, including an individual’s distributive share of income or distributions from an RPE to which an individual contributes the rights to use the individual’s image; or

(3) Receiving appearance fees or income (including fees or income to reality performers performing as themselves on television, social media, or other forums, radio, television, and other media hosts, and video game players).

The regulation also expanded on the list of business activities that are classified as SSTBs and provided several pages of detail that cannot be included here. The following is a general list of those businesses.

- Health (services by physicians, nurses, dentists, veterinarians, and other similar health care providers. But that does not apply to the businesses of spas and health clubs);

- Law;

- Accounting;

- Actuarial science;

- Performing arts (but does not apply to the services of others in the industry such as promoters and broadcasters);

- Consulting;

- Athletics;

- Financial services;

- Brokerage services (investing, investment management, trading, or dealing in securities, partnership interests, or commodities);

The wage limit amount is the greater of:

a. 50% of the W-2 wages paid by the business activity or

b. 25% of the W-2 wages plus 2.5% of the unadjusted basis of the qualified property of the business activity.

b. 25% of the W-2 wages plus 2.5% of the unadjusted basis of the qualified property of the business activity.

So, if a business activity pays no W-2 wages during the year and has no qualified property, and the taxpayer’s taxable income exceeds the top of the threshold range, the 199A deduction would be zero.

W-2 Wages – You would think determining the wages for the purposes of computing the Sec 199A wage limit would be a simple matter of just adding up the wages; unfortunately, it is not. The proposed regulations specify that wages for this purpose will only include wages paid during the calendar year. So wages earned in one year but paid in the next year would be used in the year paid. The wages include wages paid to employees, and if an S corporation, to the officers of the S corporation. Compensation paid to statutory employees (Form W-2 box 13 is checked), is not includible in the calculation of W-2 wages. However wages paid by another employer, such as a staffing agency, are included, but both businesses can’t claim the same wages. The proposed regulations provide 3 methods of determining the total W-2 wage amount. It would seem that what the regulations describe as the “Modified Box 1 Method” will be the one most frequently used by small and midsized employers. That method totals the W-2 box 1 wages, subtracts amounts that are not subject to income tax withholding, and adds the excludable pension contributions included in box 12 codes D, E, F, G, and S. Where the taxpayer is a shareholder in an S corporation or partnership the taxpayer will only use his or her prorated share of the wages from the business.

IMPORTANT ISSUE – The proposed regulations make it clear that W-2 wages must be properly allocated so only wages associated with QBI are included in the wage limitation calculation. A business entity could have non-U.S. source income, investment income, and capital gains income – none of which is QBI. An activity may have a concoction of business activities and perhaps not all of the activities produce QBI, and a W-2 wage allocation may be required

Qualified Property - The other element of the wage limitation is qualified property, which is defined as meaning tangible, depreciable property which is held by and available for use in the qualified trade or business at the close of the tax year, which is used at any point during the tax year in the production of qualified business income, and the “depreciable period” (see definition below) for which has not ended before the close of the tax year.Qualifying tangible depreciable property would include, for example:

- Machinery

- Tools

- Vehicles

- Residential Buildings (but not land; land is not depreciable)

- Commercial Buildings (but not land; land is not depreciable)

- Office furnishings

- Computer systems

- Bundled software (sold with the computer)

- Over the counter software

- Qualifying property (leasehold improvements, restaurant property and retail improvement property)

- Racehorses

- Certain fruit and nut trees and vines (once they reach production stage)

- Certain livestock (generally those purchased for draft, breeding or dairy)

- Farm buildings (but not land; land is not depreciable)

- Goodwill and going concern value

- Workforce in place

- Know-how

- Customer and supplier-based intangibles

- Government licenses and permits

- Franchises, trademarks, trade names

(a) 10 years after the placed-in-service date or

(b) The last day of the last full year of the applicable MACRS recovery period of the property (Code Sec. 199A(b)(6)(B)).

(b) The last day of the last full year of the applicable MACRS recovery period of the property (Code Sec. 199A(b)(6)(B)).

Note: The proposed regulations made it clear that qualified property that is expensed under 100% bonus depreciation or Section 179 will be included based upon their normal MACRS recovery period.

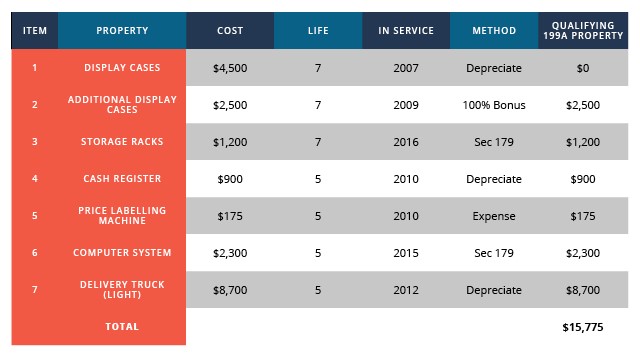

Example: Gary has a retail store that he operates in rented retail space. His property that he used in his business during 2018 included:

When looking at the example, remember that the value we use for “qualifying 199A property” is the unadjusted basis. So depreciation previously deducted and expensing is ignored for this purpose. However, property counts as “qualifying property” within its depreciable life or 10 years whichever is greater. Items 1, 4, 5 and 7 are past their useful lives but only 1 has been in service for a period greater than 10 years. So all of Gary’s property counts as “qualifying 199A property” except item #1. Thus when the wage limitation is computed for Gary the qualifying property amount used in the computation will be $15,775.

Allocating Qualified Property - The proposed regulations also specify that where the taxpayer is a shareholder in an S-corporation or a partner in a partnership, the qualified property must be allocated to the taxpayer in the same relationship as the depreciation of property was allocated.

Negative QBI - The proposed regulations also provided guidance with respect to business activities that produce a business (QBI) loss. Where a single activity is involved, the 199A deduction from that activity will be zero, and the loss is carried over to the subsequent year’s 199A computation. This is also true if there are multiple business activities and the sum of QBI from each is negative. The proposed regulation also made it clear that this carryover rule does not affect the deductibility of the loss for purposes of other provisions of the Code.

Multiple Activities - When there are multiple activities involved and one or more have negative QBI, but the total is positive, the QBI for the positive QBI activities is proportionally reduced by the negative QBI before computing the 199A deduction and the ones that were negative will have no 199A deduction and no carryover.

REITS and Publicly Traded Partnerships - The proposed regulations make it clear that the 199A computation for REITS and publicly traded partnerships (PTPs) is separate from that of the other 199A computations and has no effect on the other’s computation. Thus, should the QBI from REITS and PTPs be negative, the result will be a separate loss carryover and no effect on the computation of the business entity 199A deduction.

Cracking – This part of the proposed regulations is interesting. No sooner had the proposed regulations been released and social medias accounts lit up with posts about how the regulations had shot down “cracking.” As it turns out cracking is a name given to a scheme to divert QBI from an SSBT to a non-SSBT business activity that qualified for the 199A deduction. Apparently, the Treasury got wind of this scheme and included a provision to stifle that maneuver, much to the disappointment of those who had already organized their affairs to execute the strategy.

Here is what the proposed regulations had to say: “The Treasury Department and the IRS are aware that some taxpayers have contemplated a strategy to separate out parts of what otherwise would be an integrated SSTB, such as the administrative functions, in an attempt to qualify those separated parts for the section 199A deduction. Such a strategy is inconsistent with the purpose of section 199A”.

As a result, the proposed regulations include the following: An SSTB includes any trade or business with 50 percent or more common ownership (directly or indirectly) that provides 80 percent or more of its property or services to an SSTB. Additionally, if a trade or business has 50 percent or more common ownership with an SSTB, to the extent that the trade or business provides property or services to the commonly-owned SSTB, the portion of the property or services provided to the SSTB will be treated as an SSTB (meaning the income will be treated as income from an SSTB).

Example: A dentist owns a dental practice and also owns an office building. He rents half the building to the dental practice and half the building to unrelated persons. Under the proposed regulation the renting of half of the building to the dental practice will be treated as a SSTB.

As a wrap-up, remember the overall 199A deduction is computed in the following manner:

Step 1: Determine the 199A deduction for each individual business activity, making an adjustment for losses for each business activity separately and taking into account any loss adjustments.

Step 2: Determine the 199A deduction for REITS and publicly traded partnerships taking into account any loss adjustments.

Step 3: Multiply the taxpayer’s taxable income (adjusted down for net capital gains) by 20%.

Step 4: The Sec 199A deduction is the lesser of the amount from Step 2 or Step 3.

Step 2: Determine the 199A deduction for REITS and publicly traded partnerships taking into account any loss adjustments.

Step 3: Multiply the taxpayer’s taxable income (adjusted down for net capital gains) by 20%.

Step 4: The Sec 199A deduction is the lesser of the amount from Step 2 or Step 3.

One final note – you and others may be equal partners or S corp shareholders in a business. You might, therefore, assume that each of you will get the same Sec 199A deduction from that business activity. That is not true, because the limitations for the 199A deduction are based upon the taxable income of each individual, not the income from the business.

As you can tell, even the clarifications and IRS guidance are complicated. If you have questions related to how the 199A deduction will impact your tax return or the effect of your business entity on the deduction, please give this office a call.

|

|  |